How to buy Synthetix Network Token

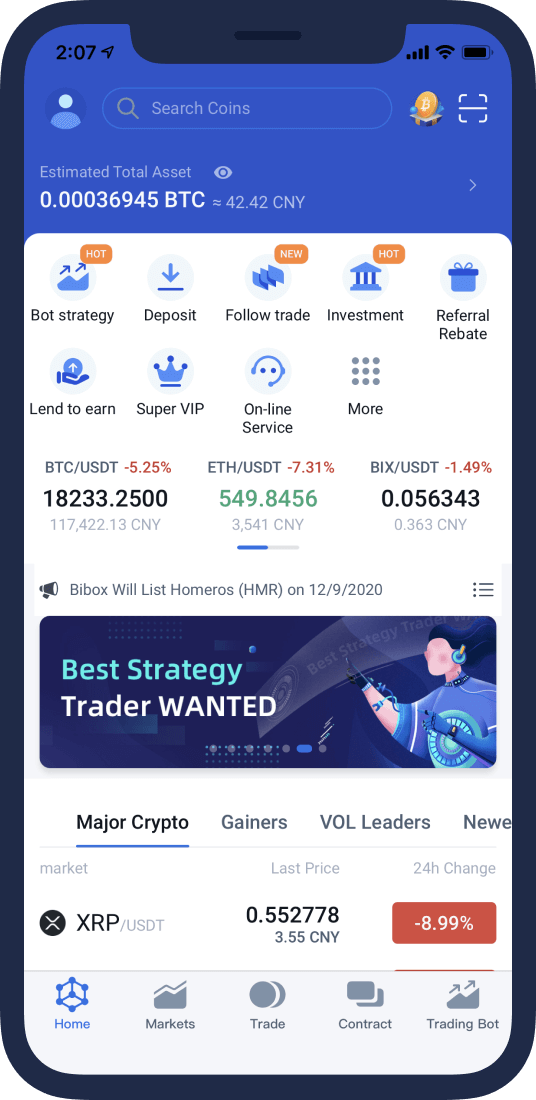

Bibox Global Professional Trading Platform

Robust Security

Safe use of microservices splitting design and AI to provide smart token and trading management

Smooth Operation

Memory matching system of megabits per second with admissible user throughput up to ten million

Multiple Coins & Trading Pairs

Support up to 90+ high-quality coins and 200+ various trading pairs

Professional Team

Professional team with rich experience in the field of blockchain, finance, digital assets and AI

Prompt Support

7*24 hours service with multilingual support to solve your inquiries instantly

Application scenarios after purchasing

Risk reminder: Digital asset transactions have extremely high risks and are not suitable for most people. You understand and understand that this investment may cause partial or total loss, so you should decide the amount of investment based on the degree of loss you can bear. You understand and understand that digital assets will generate derivative risks, so if you have any questions, it is recommended to seek the assistance of a financial advisor first. In addition, in addition to the risks mentioned above, there will also be unpredictable risks. You should carefully consider and use clear judgment to evaluate your financial situation and the above risks before making any decision to buy or sell digital assets and bear all the losses arising therefrom. We are not responsible for this.

Buy BitcoinBuy EthereumBuy BIXBuy TetherBuy XRPBuy Bitcoin CashBuy ChainlinkBuy PolkadotBuy LitecoinBuy Crypto.com CoinBuy Bitcoin SVBuy USD CoinBuy EOSBuy TRONBuy NeoBuy CosmosBuy Huobi TokenBuy DashBuy AaveBuy Ethereum ClassicBuy MakerBuy OMG NetworkBuy UMABuy yearn.financeBuy OntologyBuy Synthetix Network TokenBuy AlgorandBuy BitTorrentBuy DogecoinBuy Basic Attention TokenBuy Uniswap